Global markets fell sharply as the U.S. escalated export controls on AI chips, triggering a tech selloff and renewed volatility. Gold hit record highs, bond yields dipped, and investors are now watching Powell’s next move amid rising geopolitical and economic uncertainty.

AI Chip Stocks Slide on U.S. Tariff Escalation

Equities pulled back on Wednesday after the U.S. government imposed stricter export restrictions on advanced AI chips, targeting NVIDIA’s H20 and AMD’s MI308 models. The move marked a sharp escalation in the U.S.-China trade conflict and triggered a broad sell-off in technology stocks.

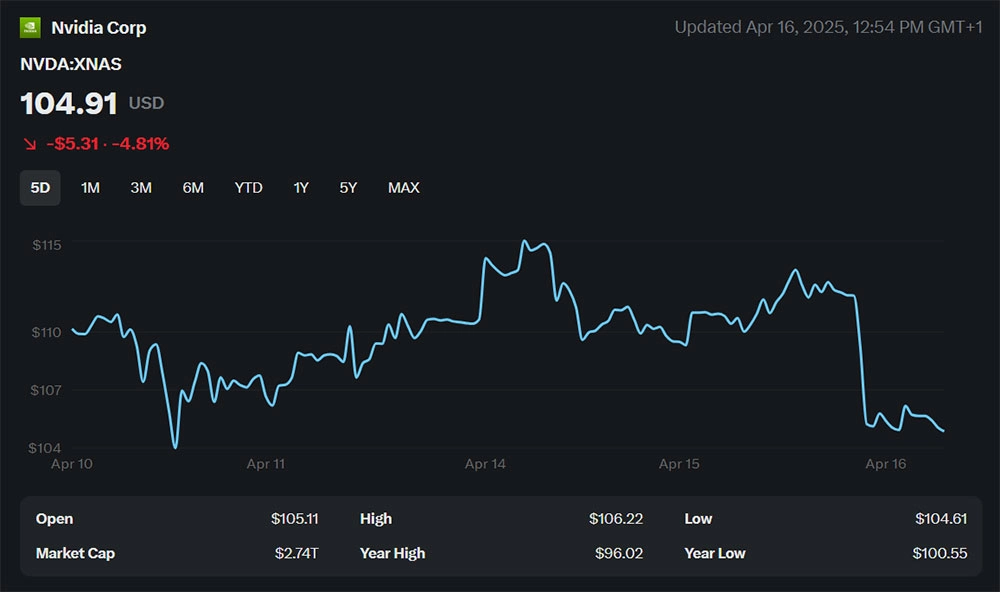

NVIDIA led the decline. Its shares fell 6% in after-hours trading to $105.50, following news of a $5.5 billion charge for the fiscal quarter ending April 27. The charge relates to inventory adjustments, purchase commitments, and reserves linked to the H20 chip, which is now restricted from being sold to China. The stock is down 16% so far this year, reflecting investor unease over mounting geopolitical risk and shrinking access to a key market.

AMD didn’t escape either, with shares dropping 4.30% to $88.50. While the numbers vary, the market’s broader reaction sends a clear signal. The AI chip sector is facing renewed uncertainty, and investor sentiment is shifting, with caution starting to replace last year’s optimism.

NVIDIA Faces $18 Billion Blow as U.S. Blocks China Chip Sales

On 9 April, NVIDIA and AMD were formally notified by the U.S. government of new, indefinite export licensing requirements for advanced AI chips. The concern, outlined in an SEC filing, is that these processors could be diverted to Chinese supercomputers. It’s not exactly subtle diplomacy.

The restrictions target NVIDIA’s H20 chip, originally developed to comply with the 2023 controls placed on its H800 line. The H20 is capable of handling AI inference tasks, but lacks the firepower of NVIDIA’s flagship models. It was a workaround that no longer works.

Estimates from Bloomberg Intelligence suggest the new rules could strip $14 billion to $18 billion from NVIDIA’s annual revenue, with China’s share of its data-centre business potentially falling to the low-single digits.

“This is a clear sign that NVIDIA now faces massive hurdles in selling to China,” said Daniel Ives, analyst at Wedbush Securities. “Investors are nervous these are the opening salvos in a tech battle with Beijing, and China won’t just walk away.”

Trump’s Chip Crackdown Escalates U.S.-China Tech War

The latest restrictions underscore the Trump administration’s hardline stance on halting China’s progress in AI and semiconductors. This isn’t a sudden shift. It’s an escalation of Biden-era policies from 2022, with the volume turned up further.

Commerce Secretary Howard Lutnick has been front and centre in the crackdown. Having just sanctioned Chinese firms, including AI startup DeepSeek, he has pushed for aggressive containment, treating the sector as a strategic battleground rather than a commercial playing field.

Inside China, Huawei remains NVIDIA’s nearest rival in the race to dominate AI accelerators. But on raw performance, it’s still a step behind. For now, NVIDIA holds the edge, although that lead is increasingly shaped by politics rather than market dynamics.

The latest ban followed closely on NVIDIA’s announcement of a $500 billion investment in U.S.-based AI infrastructure over the next four years. That includes domestic production of AI supercomputers, a clear attempt to pre-empt political risk and secure supply chains at home. It also lands amid a broader Trump administration probe into the semiconductor sector, alongside new tariffs targeting chip-enabled electronics.

Global Stocks Slide as Tech Rout Spills Across Regions

The tech-led selloff didn’t stop at Wall Street. It rippled through global markets, dragging indices lower from New York to Hong Kong.

The NASDAQ Composite, already down 4.4% since Trump’s 2 April tariff announcement, extended losses as Nasdaq 100 futures slipped 1.3%. S&P 500 futures dropped 0.7%, while Dow Jones futures fell 282 points, also down 0.7%.

In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan shed 1%, snapping a four-day winning streak. Hong Kong’s Hang Seng index slumped 1.9%, with tech stocks leading the drop. Chinese blue chips were the lone exception: the CSI300 inched up 0.3%, buoyed by stronger-than-expected first-quarter GDP growth of 5.4%, although that figure was recorded before April’s tariff tightening came into play.

Europe didn’t buck the trend. The STOXX 600 index was down 0.9%, and EURO STOXX 50 futures pointed to a 1.5% fall at the open, reflecting the same global caution.

Gold Soars to Record High as Traders Flee Risk

Amid the geopolitical noise and market jitters, safe-haven assets found their moment. Gold surged 2% to a record $3,318 per ounce, lifted by safe-haven flows and expectations of sustained demand. Analysts at ANZ see the rally continuing, with a forecast of $3,600 by year-end.

The U.S. dollar didn’t share the same momentum. The dollar index slipped 0.5%, hitting its lowest level since April 2022, a sign that investors may be growing uneasy about U.S. assets under the weight of tariff tensions.

In currencies, the traditional refuges gained ground. The Japanese yen rose 0.4%, reaching its strongest level since September. The Swiss franc climbed 0.6%, touching a ten-year high.

In Tokyo, Bank of Japan Governor Kazuo Ueda hinted at a potential shift in policy, suggesting rate hikes could be paused if U.S. tariffs begin to weigh on Japan’s economy.

Bond Yields Dip Ahead of Powell Speech, Eyes on Dovish Signal

Investors continued to shift into government bonds, nudging yields lower as risk aversion lingered. The 10-year U.S. Treasury yield dipped by 1 basis point to 4.316%, while Germany’s 10-year bund slipped 4 basis points to 2.501%, hovering near its March low.

All eyes are now on Federal Reserve Chair Jerome Powell, with markets hoping he’ll strike a dovish tone similar to Fed Governor Christopher Waller’s recent comments. Any hint of policy flexibility could shape expectations heading into the next round of data.

Speaking of which, traders are also eyeing U.S. retail sales, forecast to rise 1.3% in March. Meanwhile, earnings from a mixed slate of companies added to the market noise. Travelers gained 2.6% to $256.25, while U.S. Bancorp rose 1.7% to $39.27. Abbott Laboratories slipped 1.2% to $124.69, and Citizens Financial edged down 1.1% to $35.71. Markets are also bracing for results from ASML, a key player in the global chip supply chain.

Global trade tensions remain in the background, but the real test for sentiment may come down to how Powell frames the Fed’s path forward.