Nasdaq futures remained range-bound on Tuesday, with early selling pressure giving way to a partial recovery. The U.S. session saw volatility amid Powell’s testimony, but neither bulls nor bears managed to seize control. With key resistance at 21,900 and uncertainty surrounding tariffs, traders remain cautious as they await clearer signals.

Asian Session: Weak Start as Nasdaq Extends Downtrend

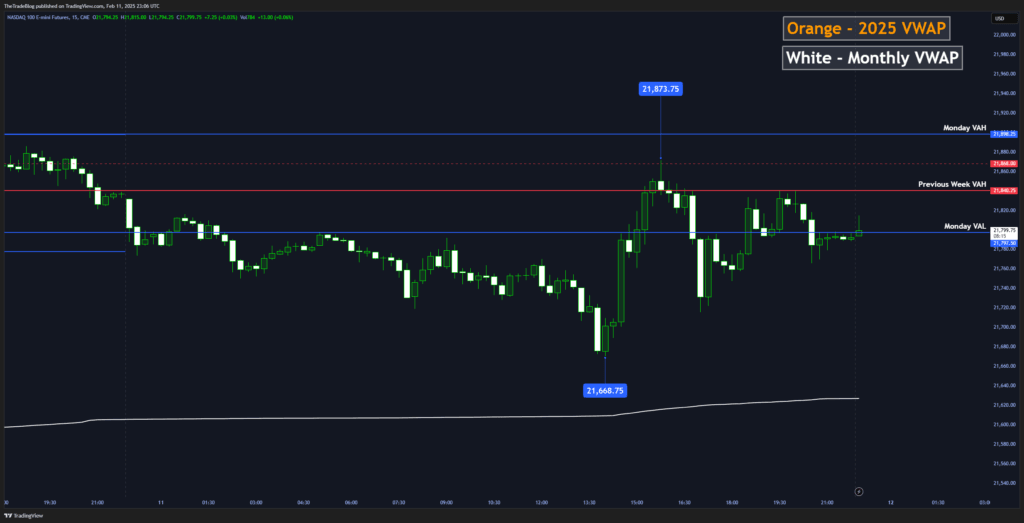

Tuesday’s session opened with a slight gap down in the Asian session, as Nasdaq futures dipped below Monday’s value area low. A brief recovery attempt was swiftly rejected, reinforcing bearish momentum and keeping the downtrend intact heading into the European session.

European Session: Temporary Support Holds, But Selling Pressure Lingers

As Europe opened, Nasdaq futures found short-term support around 21,730, forming a local bottom before renewed selling pressure drove prices to a session low of 21,668. However, buyers quickly stepped in, triggering a sharp recovery and setting the stage for a potential bullish reversal heading into the U.S. session.

U.S. Open: Aggressive Recovery Stalls at Key Resistance

At the U.S. open, buyers stepped in aggressively, wiping out the overnight decline and driving prices back toward last week’s value area high. However, resistance at this level capped the rally, leading to a period of choppy, range-bound trading. The consolidation coincided with Fed Chair Jerome Powell’s testimony before the Senate Banking Committee, injecting uncertainty and fuelling intraday volatility. Despite sharp fluctuations, neither bulls nor bears gained the upper hand, keeping price locked in a tight range into the session close.

4-Hour Chart: Nasdaq Futures Stuck in a Broader Range

On the 4-hour chart, Nasdaq futures remain confined within a broader range, with 21,450 acting as key support and 21,900 capping the upside. While price has drifted toward the upper boundary, there has been no clear breakout attempt.

Uncertainty surrounding tariffs and trade policies appears to be keeping institutional traders on the sidelines, awaiting stronger signals before committing to directional moves. For now, Nasdaq futures remain in consolidation mode, with traders closely watching macroeconomic catalysts that could spark the next major shift in momentum.