Institutional appetite for gold held strong in the first quarter of 2025, though the rhythm slowed slightly. Central banks remained net buyers, continuing their multi-year accumulation streak. The pace was more measured than the gold rush seen this time last year, but the message remained unchanged: gold still holds weight at the highest levels of monetary strategy.

What turned heads was the sharp reversal in gold-backed ETFs. After a muted 2024, inflows came roaring back as investors re-evaluated gold’s role in a landscape shaped by inflation pressures, uncertain central bank signals, and no shortage of geopolitical friction.

Sovereign wealth funds also nudged their allocations upward. Even pension funds, hardly known for chasing shiny objects, began to show renewed interest. For many, gold is no longer just a hedge. It is becoming a strategic constant, something that quietly earns its place in a portfolio without needing to shout for attention.

Central Banks Still Buying Gold, but the Frenzy Has Cooled

Central banks aren’t giving up their taste for gold any time soon. Official sector demand has now risen for 15 consecutive years, with 2024 marking the third straight year in which annual purchases topped 1,000 tonnes, according to the World Gold Council.

The final quarter of 2024 was particularly striking. As reported by Money Metals Exchange, central banks snapped up an estimated 333 tonnes, a 54% year-on-year jump and the highest quarterly tally of the year.

Q1 2025 Central Bank Buying Slows, but Stays Positive

Early signs suggest Q1 2025 is holding up, but without last year’s sprint. Back in Q1 2024, central banks added roughly 290 tonnes in a single quarter, then considered the strongest start to a year since modern records began, as noted in ETFWorld’s quarterly analysis. This year’s opening quarter appears solid by historical standards, but it falls short of that benchmark and points to a more measured approach in the months ahead.

While January 2025 got off to a slower start, it wasn’t exactly a reversal. According to the World Gold Council via Xetra-Gold, central banks added around 18 tonnes to their reserves in the opening month of the year. That’s well below January 2024’s total of roughly 39 tonnes and also shy of the 31 tonnes recorded in January 2023.

Still, a quiet January doesn’t always mean a quiet year. Even 2022, the most aggressive central bank buying year on record, began with a net sale in January before demand surged to historic highs over the following quarters.

As of March 2025, official updates point to continued, albeit moderate, gold accumulation through February, with the People’s Bank of China again among the steady buyers. Unless a wave of unreported buying emerges, Q1 2025 is shaping up to be a positive quarter overall. Central banks are still net buyers, just moving with a little less urgency this time around.

Emerging Markets Drive Strategic Accumulation

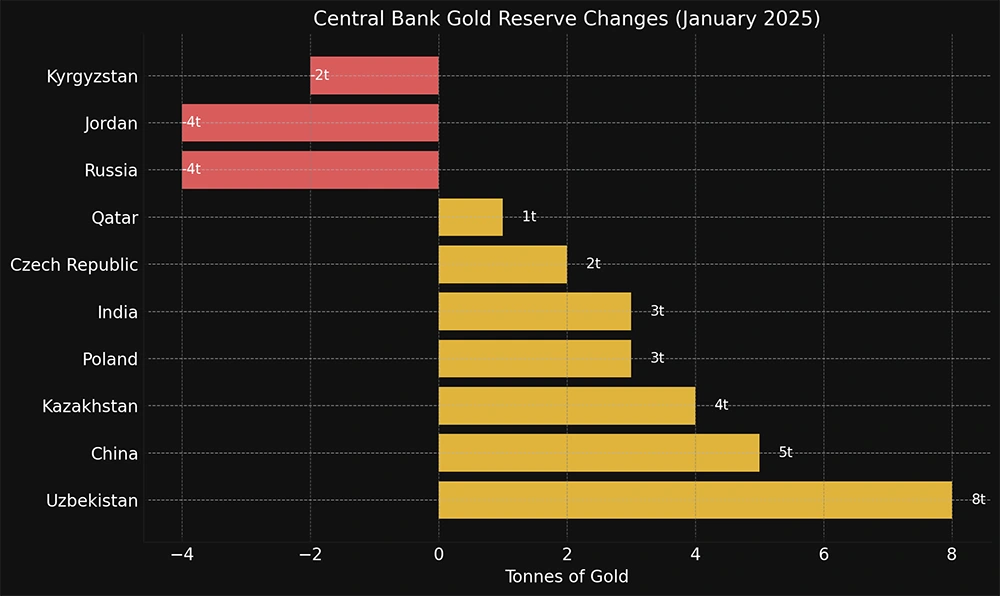

Central bank gold buying in early 2025 remained broad-based, with a clear tilt toward emerging markets and economies close to geopolitical fault lines. January data offers a useful snapshot of who’s been active and what that tells us.

Among the largest buyers, Uzbekistan led the pack with an 8-tonne addition, followed by China with 5 tonnes, Kazakhstan with 4, and both Poland and India adding 3 tonnes apiece. The Czech Republic and Qatar also made smaller moves, increasing their reserves by 2 and 1 tonne respectively. While modest in scale, these additions reflect a continued push for diversification among emerging economies, especially those positioning gold as a strategic counterweight to fiat reserves.

Poland, for instance, continues to edge toward its goal of holding 20 percent of its reserves in gold. After adding 90 tonnes last year, it is continuing to build toward that strategic threshold. Meanwhile, China’s central bank extended its buying streak into a fourth consecutive month, reinforcing its role as a consistent buyer amid shifting global tensions.

On the other side of the ledger, a few sellers emerged. Russia and Jordan each reduced their holdings by around 4 tonnes, while Kyrgyzstan sold 2. These moves appear largely opportunistic, likely aimed at capitalising on high prices rather than signalling any broader shift. Crucially, those sales have been more than outweighed by steady accumulation across the board.

Gold Remains Central to Reserve Strategy

The trend is still intact. Central banks continue to treat gold as a strategic reserve asset, not just a hedge or an opportunistic play. In 2024, official gold holdings grew by 1,045 tonnes. It was the third-largest annual increase ever recorded. The final quarter alone was a clear signal: when prices dip or uncertainty spikes, central banks step in with conviction.

That same mindset has carried into early 2025.

The sustained buying highlights the strategic importance of gold in official reserves, particularly as central banks navigate heightened geopolitical risks.

Marissa Salim, World Gold Council

This view is especially common among emerging market economies. Many have been gradually reducing exposure to the US dollar and bolstering their gold holdings as a buffer against volatility. According to Money Metals Exchange, one Indian economist recently cited a “diminished” reliability of the dollar and growing FX instability as key reasons for India’s gold accumulation. It’s a sentiment that’s far from isolated.

Gold, after all, doesn’t carry counterparty risk. And when the backdrop is noisy, economically or geopolitically, that’s exactly what many central banks want.

If the past few quarters are any indication, central banks are unlikely to step away from gold any time soon. The pace may fluctuate. The direction is clear.

ETF Inflows Rebound as Institutional Demand Broadens

After months of redemptions and retail retreat, gold ETFs are finally back in favour. In Q1 2025, exchange-traded funds linked to gold posted solid net inflows, breaking a losing streak that had defined much of the previous year. It’s a sharp turnaround from Q1 2024, when ETFs saw net outflows of 114 tonnes. Those losses weighed on sentiment well into mid-year as higher interest rates and a strong dollar undermined investor appetite.

But as the macro picture darkened and volatility crept in, gold started looking attractive again. By Q4 2024, ETF flows had flipped to +19 tonnes, contributing to a broader 25% year-on-year rise in investment demand. Not exactly a stampede, but a meaningful shift in direction.

February’s Surge Signals Broader Momentum

The momentum didn’t just carry into 2025. It accelerated. With inflation worries lingering and rate cut bets back on the table, institutions, sovereign wealth funds, and even a few cautious pension boards appear to be taking another look at bullion. If the past few months are any indication, gold isn’t just a crisis hedge anymore. It’s becoming a quiet favourite in the slow lane of capital rotation.

By late February 2025, global gold ETFs had clocked three straight months of inflows, pushing total holdings to around 3,353 tonnes. That’s the highest month-end level since mid-2023. In February alone, investors funnelled in 108.3 tonnes, worth approximately $9.4 billion, marking the strongest monthly intake for gold funds since the chaos-driven rush of March 2022.

North America did most of the heavy lifting. According to Money Metals Exchange, U.S.-listed ETFs absorbed 48 tonnes in just one week, the fastest pace since the early pandemic-era scramble for safe-haven assets. Asia followed with strong inflows led by Chinese investors, while Europe also managed modest gains.

Compared to early 2024, the shift is stark. Back then, capital was fleeing gold. Now, it’s coming back in size. If this momentum held through March, Q1 2025 likely ended with well over 100 tonnes in net ETF inflows. That would be a sharp reversal from the triple-digit outflows recorded the year before.

According to the World Gold Council, this latest stretch of demand has nearly unwound the multi-year redemption cycle that had weighed on the market since post-COVID monetary tightening took hold.

Policy Pivots and Volatility Reignite Gold Investment Demand

The gold ETF revival isn’t just a feel-good moment for bullion bulls. There are very real forces behind the surge.

First, the monetary tide has turned. Bond yields have been easing since the start of the year, softening gold’s opportunity cost. The Bank of England threw a curveball in February with an unexpected 25 basis point rate cut, and markets now expect the European Central Bank to follow suit. A weaker dollar hasn’t hurt either. All of this has quietly tilted the macro backdrop in gold’s favour.

Then there’s the more colourful stuff. Geopolitics, trade tensions, and a whiff of stagflation have all kept investors on edge. By late February, gold had smashed through to a new all-time high, driven in part by renewed friction between the U.S. and China. New tariffs, retaliatory threats, and Beijing’s fiscal stimulus push added fuel to the fire, as Reuters reported.

Momentum has also done its usual trick. In February alone, the price of gold broke nine new records. That kind of action tends to trigger a little FOMO. Sure enough, ETF flows reflected it. Global funds absorbed over 108 tonnes, worth $9.4 billion, in February alone, the strongest monthly intake since March 2022, based on World Gold Council figures.

Put it all together and gold looks less like a relic and more like a well-timed rotation. And for now, the momentum seems to have real legs.

Sovereign Wealth Funds Quietly Accumulate Gold

Beyond ETFs, other institutional players are also making quiet moves into bullion. Sovereign wealth funds (SWFs), in particular, have shown a growing appetite for gold as a long-term strategic hedge. These are no small players. With deep pockets and long horizons, many SWFs are beginning to mirror central banks, not just in rhetoric but in actual allocation.

Take the State Oil Fund of Azerbaijan (SOFAZ). It resumed gold buying in recent years, adding 25 tonnes in the first three quarters of 2024, with gold accounting for nearly 18% of its assets by the end of Q3, according to the World Gold Council. That’s not a casual allocation. It’s a deliberate hedge.

In the Middle East, Qatar has long held sizeable official gold reserves (some housed within its central bank), while other regional funds are exploring mining stakes or gold ETFs. Official monthly data for Q1 2025 remains sparse. SWFs rarely share their cards. Still, the broader trend is increasingly clear: sovereign investors are taking cues from central banks and quietly bulking up their gold exposure.

The drivers aren’t complicated. Like their central bank cousins, SWFs are wary of dollar risk, unimpressed by long-term bond returns, and mindful of geopolitical turbulence. If you’re sitting on hundreds of billions in petro-revenues or FX reserves, why not park a sliver in something that doesn’t come with someone else’s debt attached?

What Drove Gold in Q1 2025

Q1 2025 wasn’t exactly a dull affair, and unsurprisingly, gold found itself firmly in the spotlight. Institutional demand surged, and it wasn’t down to luck. Several macro forces aligned at just the right moment: monetary policy shifts, persistent inflation, geopolitical tensions, and the inevitable market psychology that follows when gold starts moving.

Policy: From Tightening to Tilting

After the aggressive rate hikes of 2023, central banks eased up in early 2025. Slower growth and moderating inflation gave policymakers the green light to dial back. The Fed held steady but signalled potential cuts later in the year, while bond yields began their downward drift. In Europe, the Bank of England caught markets off guard with a 25bps cut, and the ECB continued leaning dovish.

For gold, it was like music to its ears. Lower yields meant less opportunity cost for holding bullion, and a weaker dollar only added to the allure. ETFs saw fresh inflows as a result, and central banks, not known for being especially price-sensitive, remained committed. In short, easy money was back, and gold was back in favour as a solid store of value.

Inflation: Cooling, but Still in the Rear-View Mirror

While the worst of the price spikes may be behind us, inflation remains stubbornly above target in many regions, with real interest rates still frustratingly low. This has ensured that gold’s role as a hedge against inflation remains top of mind for institutional investors looking to preserve value in a volatile economic landscape.

The memories of 2022 and 2023, marked by surging prices, are still fresh. Whether it’s the currency risks in emerging markets or the overwhelming weight of global debt, pension funds and sovereign wealth funds continue to see gold as a safe haven. Even with inflation cooling, few believe the risks have disappeared. Gold’s 27% rally in 2024 speaks volumes, with investors still hedging against the possibility of future price pressures.

If there’s one thing that reliably nudges gold back into favour, it’s geopolitical upheaval. Q1 didn’t disappoint. The U.S. and China decided to rekindle their tariff spat, as if stuck in a rerun of 2018, rattling markets and propelling gold above $3,000 an ounce by the end of February. Meanwhile, the war in Ukraine trudged on, casting a long shadow over investor sentiment and keeping the global mood firmly in the defensive camp.

Against this backdrop, central banks in less-than-calm corners of the world quietly kept stacking bullion. Whether dealing with sanctions, wobbly domestic politics, or looming external threats, the rationale was straightforward. Gold doesn’t come with strings attached. There’s no counterparty risk, no one to default, and no central bank to freeze your assets.

Retail demand followed a similar script. In regions where governments can’t be fully trusted, or where currencies inspire more dread than confidence, bar and coin buying picked up steam. When trust in institutions wavers, gold quietly resumes its role as the people’s reserve.

The World Gold Council didn’t mince words. The narrative is shifting from bullets to balance sheets, from tanks to tariffs. And if there’s one environment where gold tends to shine, it’s precisely this mix of real-world conflict and financial brinkmanship.

Geopolitical Tensions Keep Gold Firmly in Focus

If there’s one thing that reliably pushes gold back into the spotlight, it’s geopolitical friction. Q1 delivered more than its fair share. The U.S. and China appeared determined to relive 2018, slapping tariffs on each other like it was muscle memory. Markets flinched, and gold surged past $3,000 an ounce by the end of February. Meanwhile, the war in Ukraine dragged on, adding to a general mood of global unease.

In response, central banks in politically sensitive regions quietly kept buying. Faced with sanctions, domestic instability, or broader external threats, they had little incentive to stop. The reasoning was straightforward. Gold doesn’t come with strings attached. There’s no counterparty risk. No one can freeze it, default on it, or devalue it overnight.

Retail investors played their part too. In countries where faith in institutions runs thin and currencies feel more like liabilities than assets, demand for bars and coins accelerated. When trust in officialdom evaporates, gold steps back into its role as the people’s reserve.

As the World Gold Council bluntly put it, we are shifting from military conflict to financial confrontation. For gold, that is a near-perfect backdrop. It doesn’t need optimism. It just waits for doubt.

Conclusion: Quiet Conviction, Strategic Positioning

Gold didn’t just hold its ground in Q1 2025. It settled in like it belonged there. Central banks kept buying, ETFs reversed course, and sovereign wealth funds edged further into the fold. It wasn’t a scramble. It was steady, calculated, and quietly telling.

This wasn’t about chasing headlines or reacting to market noise. It was about institutions reassessing what stability actually looks like in a world where policy pivots are frequent, inflation still hums in the background, and geopolitical tension is part of the daily landscape. Gold, once the outsider, is now quietly making its case as core allocation material.

There’s no drama here. Just a slow, deliberate shift in how capital behaves when certainty is in short supply. If Q1 was the warm-up, the main event may yet come. But gold’s seat at the table looks increasingly permanent.