Asian Session: Bullish Gap on Tech Earnings

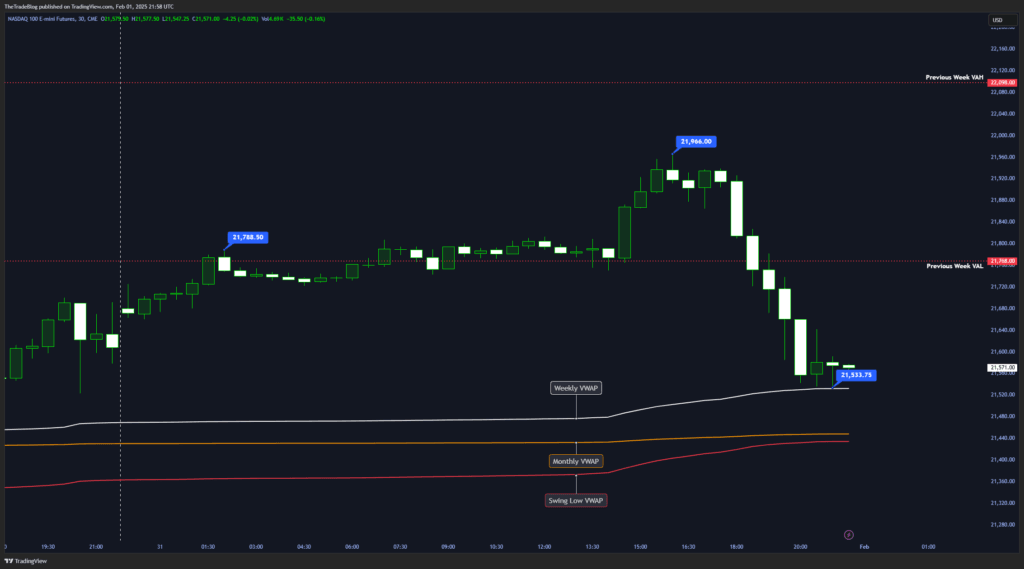

Friday’s session opened with a bullish gap in the Asian session, driven by strong tech earnings, particularly from major names like Apple. This surge pushed Nasdaq futures toward the previous week’s value area low, peaking at 21,788. However, buyers struggled to sustain momentum, and price soon consolidated at this key level.

European Session: Holding at Resistance Amid Consolidation

During the European session, Nasdaq futures hovered near resistance at the previous week’s value area low. Buyers attempted to push higher but lacked the necessary momentum to break through. Instead, the market traded in a narrow range, setting the stage for heightened volatility in the U.S. session.

U.S. Session: Bullish Start Reversed by Tariff News

The New York session opened with a strong push, sending Nasdaq futures to 21,966, hoping to confirm its breakout. However, that momentum quickly collapsed after reports surfaced regarding potential new tariffs on China, Mexico, and Canada. This led to an aggressive sell-off, pushing price below the previous week’s value area low.

Nasdaq futures eventually settled at the weekly VWAP at 21,533, where some stability emerged. The rejection from 21,966 signalled a clear shift in sentiment, with sellers taking control of the session.

Market Drivers: Tariff Concerns

Beyond technical levels, fundamental catalysts contributed to Friday’s Nasdaq decline. Investor sentiment weakened following reports that the U.S. may introduce new tariffs on China, Mexico, and Canada. The White House announced potential 25% tariffs on imports from Canada and Mexico, and 10% tariffs on Chinese goods, fueling concerns over global trade policy. This uncertainty triggered risk-off sentiment, particularly within the tech sector (source: Associated Press).

Outlook & Key Price Levels: Where to Watch Next

With price settling near 21,533 (weekly VWAP), the next move depends on how buyers react at this key level. If buyers defend 21,533, a rebound toward 21,788 could be in play. However, if selling pressure persists, further downside movement may develop.

Friday’s session revealed a market that tested critical resistance levels before sharply reversing on tariff news and profit-taking. As we head into Monday’s session, the key question remains: Was this sell-off an overreaction, or does it signal a broader sentiment shift? Traders will be watching closely to see if the current move represents a temporary shakeout or the start of a larger downtrend.